The recent destruction caused by Hurricanes Katrina and Rita serves as a reminder of the type of havoc Mother Nature can cause. Water, wind, fire and earth movement can be hazardous to your home, perhaps your most cherished and largest investment. But, there are actions you can take now to protect your property and prevent major damage should one of these elements strike. Depending on the age of your home and the building codes in your area, some of these improvements may already be in place.

WaterApart from major flooding, most damage occurs when water seeps in through cracks and leaks. Make sure that windows and doors are well sealed. Seal any cracks and holes in the foundation and exterior walls. Repair or replace roof shingles around any area that allows water to penetrate the roof sheathing. Check for holes or air leaks in the attic and basement. Your basement windows and doors should have built-up barriers or flood shields. Inspect your sump pump regularly to make sure that it is working properly. Install or make sure that the flashing, a thin metal strip, around the doors, windows, thresholds, chimney and roof are in tact.

WindMinimize the damage by keeping the wind from getting inside your home. Windows and glass doors should be fitted with impact-resistant laminated glass or covered with impact-resistant shutters. Consider solid wood or hollow metal doors, which are more likely to resist wind pressure and flying debris. There are also roofing products with high wind resistance available.

WildfireSome inexpensive home improvements that you can make include installing a spark arrestor on your chimney, eliminating brush and debris from around your property, and modifying your attic, sub-floor and basement vents. More expensive improvements include replacing single-pane glass windows, doors or skylights with tempered glass, recovering your exterior walls with a more fire-resistant material, and re-roofing your home with a Class A roof covering.

Earthquake

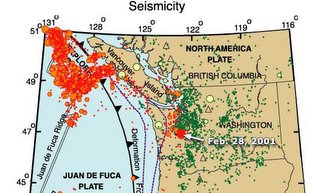

California isn't the only earthquake zone. Other zones include the New Madrid region, west and just east of the Rockies, the southern Appalachians, New England, Alaska, and here in the Pacific Northwest. Steps you can take to protect your property and possessions include anchoring appliances, water heater, dressers, and other heavy items to the wall. Attach your TV, computer and other small appliances to desks, tables or countertops. Secure ceiling lights, chandeliers and other hanging items to the permanent structure of your home. Apply safety film to windows and glass doors. It is also a good idea to install a main gas shut-off device.

Of course, there may be times, when no amount of prepping can protect your home. However, homeowners insurance can help protect you financially in case something happens to your property or its contents. Most standard homeowners insurance policies include structural coverage and personal property coverage. Depending on your location, you may also need additional coverage against earthquake, hurricane and fire.

Be aware that flood damage is not covered under the traditional homeowners insurance policy. Flood insurance needs to be purchased separately through the National Flood Insurance Program (NFIP), a federal program. It is available to nearly 20,000 communities across the U.S. and its territories that participate in the NFIP. Flooding can be caused by heavy rains, melting snow, inadequate drainage systems, failed protective devices such as levees and dams, as well as by tropical storms and hurricanes. So, although you may be in a low to moderate risk area, you may still want to consider this coverage.

Periodically review your homeowner's insurance policy to make sure that you are adequately covered to rebuild your home and replace your contents.

If there is ever damage to your personal property, having a home inventory can make it easier when filing an insurance claim. Start with a sheet a paper for each room in the house. Go around the room and list every item. Don't forget the attic, basement or other storage places. For each item, write the original cost, purchase date, replacement cost, model number, brand name, where purchased, and a general description. In addition, take photos or video of each room for visual documentation. It is also a good idea to arrange valuable collections, silver, jewelry, etc. and take close up photos. Make sure you update your home inventory photos and list at least once a year.

When weather-related disasters strike, what's most important is your safety and that of your family. However, by taking precautions to protect your home, you can possibly help keep damage to a minimum; or in the case of severe damage, make sure that you have the financial means to rebuild.

For more information go to

http://www.ibhs.org/ or

www.fema.gov.

Prudential Olympia, REALTORS is an independently owned and operated member of Prudential Real Estate Affiliates, Inc., a Prudential Financial company. Equal Housing Opportunity.

Labels: prudential, real estate